The Markets

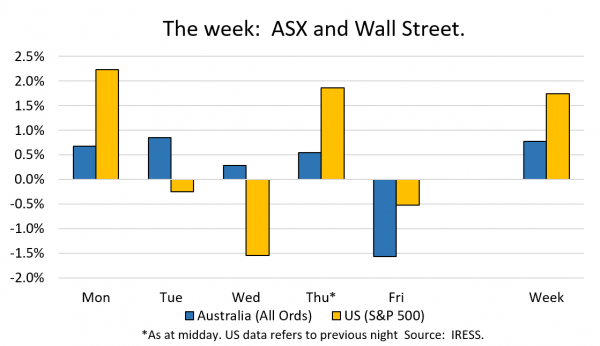

This week: ASX v Wall Street

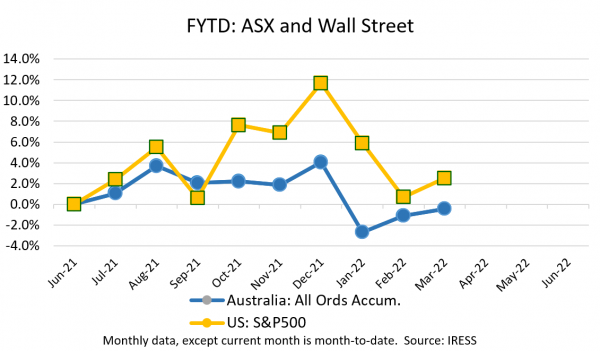

FYTD: ASX v Wall Street

Monday marked the end of the February Profit Reporting Season.

With restrictions eased across much of Australia, reported profits should have less of a COViD handicap than they have had for the last two years. This hopefully represents a point where there are clearer skies ahead for corporate Australia.

All in all, this reporting season companies have outperformed expectations: profit ‘beats’ have far outweighed profit ‘misses’ (Source: Wilsons).

However, despite the direct costs of COViD fading (lockdowns and restrictions), the policies and changes we have seen in response continue to reverberate throughout the economy.

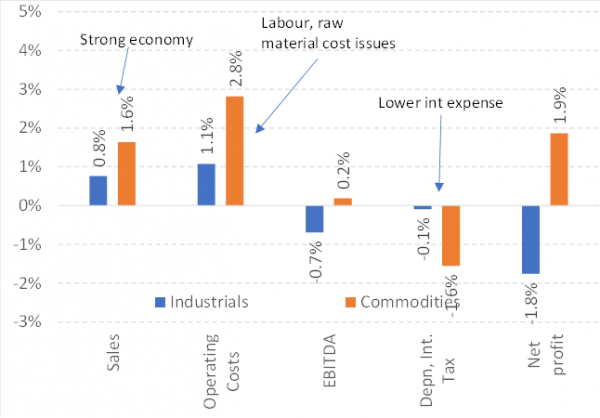

There continue to be challenges, principally rising costs. This reporting season, it was evident that companies have been able to increase their prices in response. However, cost pressures have not been completely offset, shrinking profit margins overall.

This can be seen in the chart below, which shows analysts’ revisions to their forecasted profits for the full year. Indeed, operating costs have been revised upwards relative to expectations. While this has been offset by sales to some degree, overall, profits (EBITDA) have been squeezed.

Rising sales far outweighed by costs

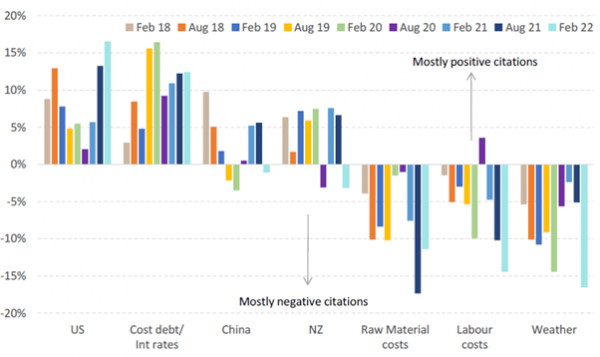

Unpacking this further, while it appears concerns about raw material costs (and shipping rates) are easing, rising labour costs are increasingly a topic of focus.

This is shown in the chart below, which highlights the net positive (or negative) citations on company earnings falls over the past 4 years:

Your Companies – a summary

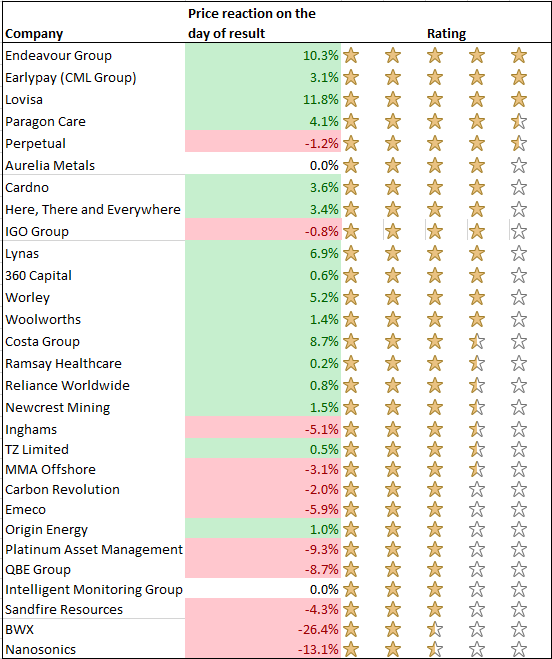

A snapshot of the results from your companies over the August Profit Reporting Season is provided below.

We take a look at how they weathered the first half of FY-22 and the outlook for the rest of the year.

Company description: Reliance is a designer, manufacturer and supplier of water flow, control and monitoring products/solutions for the plumbing and heating industry. Its flagship products are push-to-connect fittings, pipe fittings (SharkBite, Speedfit) and associated piping. Sales are through retail (HomeDepot, Lowes) trade and wholesale channels. Major markets include the US (main), UK and Australia.

1H-FY22 Result

- Activity in the repair and remodel market has continued to be strong – with low-interest rates, a shift to working from home and a buoyant housing market providing support. The US grew strongly, as too Australia (with a rebound in residential construction), however, Europe was a little weak after a very strong half last year. All in all, Reliance’s strong sales growth continued, despite already on a higher base post-COVID

- However, this did not fully translate into profit growth. Margins have been impacted by cost pressures (rising cost of freight, labour and raw materials such as copper, resin and steel). This has been partially offset by price increases and cost reductions and is expected to be offset by further price increases in the next half.

FY-22 and beyond

- The company is spending to significantly expand its production capacity this year. Management has expressed confidence that the strong sales we have seen post-COVID represent a new base.

- The trajectory of sales and ability for Reliance to offset cost increases remain key to its outlook.

- We continue to like Reliance because we see that it is a quality company with strong pricing power – its products are built on a reputation of reliability that has been built over decades and it continues to present a strong value proposition for end-users, retailers and wholesalers alike.

Company description: Endeavour Group’s assets are better known to readers as Dan Murphy’s retail liquor network, BWS retail liquor assets (often co-located with Woolworths supermarkets) and the lesser-known ALH Hotel network of over 300 hotel venues.

1H-FY22 Result

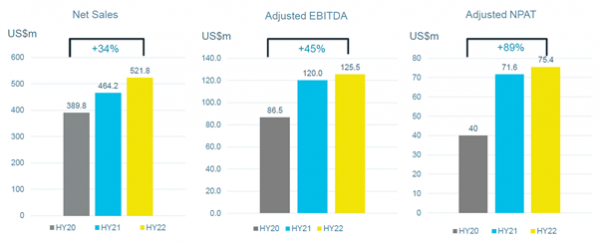

- We were tempted to pop open a bottle of champagne after reading Endeavour’s result last Monday. We have long believed that savings accumulated on household balance sheets would spill into the economy as it re-opens, and Endeavour was a great example of this.

- In retail, it appears that households were not only eager to spend on liquor as they came out of lockdown – but also traded up, purchasing “premium products”.

- This translated into very strong gross margins for Endeavour: with more premiumisation, less discounting and more sales of its higher-margin Pinnacle brands.

- This was complemented by excellent cost control, which saw distribution costs and employee costs contained despite the ongoing price pressures we have seen.

- Hotel earnings remained suppressed (given lockdowns during the period), however, cost control was once again impressive, with higher margin gaming revenue supporting the result.

FY-22 and beyond

- Endeavour traditionally has seasonal earnings with a weaker second half.

- However, for us, the big picture is that the business has likely had several learnings through COViD. This includes its ability to run leaner with respect to staffing and change the way it manages its inventories. This excites us, as it may allow it to sustain higher returns into the future.

Company description: Nanosonics is a medical device company that produces the Trophon: a disinfection device that utilises a hydrogen peroxide mist to sterilise ultrasound probes.

1H-FY22 Result

- Nanosonics’ result was a little weaker than we expected.

- The result was impacted by two main factors: COViD disrupting sales, and a changing sales model (changed distribution agreement with GE Healthcare).

- The market continues to have trepidations about the change in GE’s sales agreement, which we see as an opportunity.

FY-22 and beyond

- Costs are expected to be slightly higher in the second half as the revised sales agreement is implemented.

- The company is confident the revised model will not only lead to higher margins but the opportunity for additional sales through servicing customers directly.

- We see upside as the impact on margins and sales is better understood, as well as the release of its new endoscope reprocessing product platform, Nanosonics Coris.

Company description: QBE is a general insurer and underwriter, with diversified global exposure (it writes policies in North America, Europe, Australia & New Zealand and the Asia Pacific).

FY-21 Result

- It’s no news to readers that insurance premiums continue to rise – dramatically so in fact.

- As such QBE has continued to see strong premium growth across all geographies – a clear positive.

- However, the result was somewhat disappointing as the company has put aside funds for expected increases in claims costs as a result of inflation. Whether this inflation in claim costs eventuates remains to be seen. Furthermore, the company has decided to take on less risk through purchasing additional insurance against large and catastrophe claims, which dragged down its profit margins.

FY-22 and beyond

- Rising interest rates and premiums can be extremely material to insurers’ margins, particularly when one leads the other (i.e., premiums rise in response to low-interest rates to preserve profitability and then rising interest rates generate additional profitability on this base from investment income).

- QBE’s change in provisioning comes at a time when it has seen a transition in its management team (a change in CEO). It remains to be seen whether this accounting is proved to be conservative over the long term, releasing profits in the future and allowing further capital for growth. We continue to see QBE as an essential portfolio exposure to rising interest rates in the medium term.

Company description: Costa is a large fruit and vegetable grower. Its produce includes berries, avocados, mushrooms, citrus varieties and tomatoes which are sold in both domestic and international markets.

FY-21 Result

Initial trading in CY22 positive. Agricultural enterprises are notoriously volatile in the short-term and value creation in the long run. Weather, pricing, and yield across a range of categories create many moving parts, and Costa is further complicated by an exposure to citrus with its biennial peaks and troughs in production.

Amongst the noise, the market is looking for a guide to long-term capital efficiency, improvements in the quality of supply chains, and the development of varieties and other forms of innovation. There were strong signs of improvements in these long-term measures, especially in mushrooms.

Qualitative commentary at a category level was generally favourable. Domestically, CGC is seeing strong berry volumes and favourable pricing, tomato volumes are ahead of CY20, mushroom production volumes are significantly improved versus CY20. Early season China yields and demand are above expectation, with the Moroccan berry harvest building against a strong demand backdrop.

Building value through scale and access to capital

The most pleasing aspect of the result and subsequent discussions with management was the concrete signs of the company being rewarded for its scale and supply chains. Berries, which have had a tumultuous past 2yrs achieved higher than expected pricing due to the company’s capacity to guarantee supply in what has otherwise proven to be a volatile market.

Company description: Carbon Revolution is an innovative manufacturer which utilises carbon fibre technology developed in Australia (Deakin University). Produces carbon fibre wheels for performance and luxury cars – such as the Ferrari 812 Competizione and Corvette C8 Z06.

1H-FY22 Result

- It was another challenging half for Carbon Revolution

- The company has been significantly impacted by COViD for the 6 months to December – with semi-conductor shortages impacting customer demand and impacts on labour availability, inputs and freight costs. In addition, production challenges have resulted in higher costs.

- These culminated in higher costs per wheel, slowing the company’s progress towards profitability.

- The company continues to progress the build-out of its more automated ‘mega line’ – which will bring with it substantial labour and cost savings.

- Pleasingly, the company has secured additional funding to assist with its working capital needs in the interim.

FY-22 and beyond

- A small position in portfolios, Carbon Revolution has made significant progress commercialising a technically challenging advanced manufacturing process and continues to be a world leader in the design and manufacture of carbon fibre wheels.

- Its success will continue to be dependent on its ability to successfully implement its mega-line and achieve associated labour cost efficiencies to bring its cost per wheel down. As it begins to achieve this, we expect the company and its share price to gain momentum.

Company description: Food and beverage retailer that operates over 1,000 supermarkets across Australia and New Zealand. The company also has an exposure to discount general merchandise through Big W.

1H-FY22 Result

- Woolworths achieved a profit in line with the revised expectations it signalled to the market in December.

- The added safety precautions we all saw at the supermarket have come with a significant cost: costs associated with COViD featured prominently and had a $239m impact on profitability. These costs included supply chain transition costs, staff costs, additional security and cleaning/PPE.

- While the market focused on elevated costs more generally, we see this as a function of Woolworths investing in digital, data, and online to extend its lead over Coles.

FY-22 and beyond

- Importantly, Woolworths was open about the fact that prices are beginning to rise in supermarkets (something readers are no doubt already aware of), with prices up 2-3% over the calendar year (compared to last year).

- While this isn’t great news for consumers, it is tremendously material to supermarkets’ profitability. To give an idea of this leverage: with sales this half of $32bn and an operating profit of $1.4bn, a 2% rise could have resulted in a $0.64bn increase in profit.

Company description: Worley provides engineering design services as well as procurement, construction project management, maintenance, reliability, support and advisory. This includes oil and gas (hydrocarbons), chemicals, mining and metals. The company increasingly moving into renewables and applying its expertise to assist with the global energy transition that is underway.

1H-FY22 Result

- Worley’s first-half result was an improvement, with higher-margin professional services making up a greater part of its revenue mix. This resulted in an overall improved profit margin.

- The usual leading indicators of Worley’s revenue remain positive: backlog strengthened as well as its headcount.

- The company continues to demonstrate its capabilities in the sustainability domain and highlighted several projects it has recently been awarded. It will be incurring higher costs ($13m) as it invests in broadening this capacity.

FY-22 and beyond

- Traditionally, Worley’s margin is higher in the second half of the year. However, it expects margins to be flat in the second half of this year, which the market was disappointed by.

- Longer term, Worley has an opportunity to benefit from the huge amount of capital investment required to transition to sustainable sources of energy. We see it as one of few exposures on the ASX to the wave of capital investment that is to come.

Company description: Media and entertainment company. Operates Australian Radio Network (ARN) including radio stations KISS 101.1 and Gold 104.3. HT&E is also the Australian licensee of podcasting network iHeartRadio. It recently expanded its regional footprint with the acquisition of Grants broadcasting.

FY-21 Result

- Radio is back (well, almost). While HT&E’s radio revenues have not returned to pre-pandemic levels, revenue across the radio market in the fourth quarter was in line with revenue achieved in 2019.

- However, this has not all fallen through to the bottom line, with some of the costs saved during COViD returning. In addition, there are still some labour pressures for the business.

- The company’s digital revenue continues to grow, as the company looks to monetise its iHeartRadio platform and podcasting.

- The other (smaller) part of the company: its Hong Kong digital advertising business continues to wind down, with the roll off of an unprofitable contract over the half.

FY-22 and beyond

- The company is looking to push further in acquiring digital audiences and will spend $8-9m developing original podcasts as well as taking its “Edge” program to digital audiences. Digital continues to present an opportunity for the business.

- However, what is more, important in our view, is its ability to capitalise on its recent acquisition of regional radio network Grants Broadcasting and attract more advertisers to regional radio. We met with the company’s management last week and gained a better understanding of the company’s strategy to achieve this.

- We continue to see HT&E as a cashflow generative business, with the realisation of revenue synergies from Grants and the sale of its stake in Soprano remaining important catalysts.

Company description: A longstanding position in client portfolios, Earlypay (formerly CML Group) is an invoice and equipment financing company that finances SMEs. It has grown its business over many years both organically and through acquisition.

1H-FY22 Result

- Earlypay upgraded its profit forecast for the third time this year.

- Needless to say, its result was ahead of our expectations, with the amounts drawn improving as customers draw down more of their facilities with a return to activity and the rolling off of support measures.

- Expansion of the company’s trade finance product provided good support to margins and the company’s equipment finance book is back to growth.

- Most importantly, the company is demonstrating good operating leverage – as revenue rises costs are rising by a much smaller amount.

FY-22 and beyond

- We met with the company early last week to discuss the result.

- There is further upside for growth of the business, be it organic through invoices funded and its equipment finance book or inorganic through acquisition (which it has successfully executed throughout its history). Importantly, invoices funded grow with the economy, and therefore EarlyPay’s revenue grows with inflation. The company can improve its funding mix (interest costs) which should also help profitability.

- We continue to see the company as cheap – it continues to grow and will pay a 6-7% dividend this year.

Company description: Paragon is a wholesaler to the healthcare sector, including hospitals and aged care, around Australia. It provides a variety of necessary consumable goods (such as surgical instruments) as well as more specialized devices and instruments.

1H-FY22 Result

- We met with Paragon’s management early last week.

- The business had a challenging half which was impacted by COVID. Restrictions on elective surgery reduced sales of consumables into hospitals (Paragon’s largest segment) and more broadly across its pillars (for instance, sales of intraocular lenses in Devices). This was, however, somewhat offset with other COViD related sales.

- Of focus of us was the merger with Quantum – a diagnostic equipment distributor (such as MRI and ultrasound equipment) that operates in Asia. The merger transforms the business in several respects, firstly growing its size, secondly, reducing its leverage (debt relative to profits) and thirdly opening more distribution channels for its products.

- Management sees that this will open up a significant opportunity for revenue growth, with $100m in revenue growth targeted across the next 3-5 years.

FY-22 and beyond

- With the removal of restrictions on elective surgery, we should see Paragon return to growth in the second half. We are particularly focused on the Total Communications business (Service and Technology), which demonstrated excellent revenue growth pre-covid as well as the Diagnostics business, which should benefit from sales of blood reagents into Asia.

- The company has been transformed by the merger with Quantum. With a lower level of leverage (debt relative to profits) opportunities have been opened up for both organic and inorganic growth.

- We look forward to furthering updates on the company’s strategy at its full-year result, where its new CEO Mark Hooper (formerly CEO of Sigma pharmaceuticals) will present.

Company description: Sandfire Resources Limited is primarily a copper producer. It explores for, evaluates, develops mineral tenements and projects in Australia and internationally.

1H-FY22 Result

- Sandfire’s results were largely in line with expectations – given mining companies update the market quarterly on their production performance.

- However, there were some disappointments concerning costs including exploration expenses (higher than anticipated), shipping costs and the impact of hedging.

FY-22 and beyond

- The market was largely focused on Sandfire’s commentary around the recently acquired MATSA Mining Complex in Spain. The company expects costs to be higher for the second half of the year at the mine – due to higher energy costs (electricity prices) and the grade profile that is being put through the mine.

- This has caused some trepidation in the market, with the uncertainty impacting its share price.

- However, we continue to see the company as cheap when taking a long-term view.

Company description: BWX is a manufacturer of masstige natural skincare and beauty products. It has several household-name brands under its umbrella, including Sukin, Andalou, Mineral Fusion, Go To as well as online marketplaces Nourished Life and Flora & Fauna.

1H-FY22 Result

- BWX’s sales were significantly weaker than the market expected, with lockdowns impacting the company in the first quarter of the year. Online sales (Nourished Life) in particular, were disappointing.

- However, with sales rebounding in the second half and a full year contribution from Go-To, the company should see a material uplift in profits.

- Furthermore, the completion of the company’s new manufacturing facility in Clayton is expected to bring a significant uplift in gross margins from 2023 onwards.

FY-22 and beyond

- BWX is a small position that we hope to build over time.

- Despite the short-termism around sales, we see upside as the company has succeeded in continuing to broaden the distribution of its brands in both Australia and the US, including the newly acquired Go-To brand.

Company description: Predominantly an investment manager (Perpetual Asset Management) which is expanding its global presence. Other business segments include Perpetual Private and Perpetual Corporate Trust which provide a range of services including financial planning, investment administration and custody.

1H-FY22 Result

- Perpetual showed a strong uplift in profit, with recent acquisitions (such as Jacaranda Financial Planning and Barrow Henley) boosting its bottom line.

- The company continues to grow the distribution of Barrow Hanley and Trilliums funds, with net flows in Barrow Hanley beginning to turn around faster than expected.

- A key focus of ours was the expense line, which pleasingly the company does not expect to grow beyond levels it previously guided towards.

FY-22 and beyond

- With performance beginning to improve across Perpetual’s funds, we are optimistic it will be able to capitalise on its recent acquisitions, growing its distribution and attracting more funds under management.

- We note that Perpetual’s funds have a heavy bias towards value stocks which we believe should outperform in an inflationary environment.

Company description: MMA Offshore is a marine services company that owns and operates a fleet of offshore service vessels (OSVs). Offshore service vessels are used in several capacities, including in offshore oil, gas and wind projects. The company recently acquired Neptune Marine, a subsea services business (underwater inspection, repair and maintenance).

1H-FY22 Result

- MMA delivered a reasonable result in what is still a challenging environment for offshore vessel operators. The industry is yet to see the higher oil price flow through to higher activity and COViD disruptions continue to have an impact on costs.

- The company saw some material contract wins over the period, including the long-term re-leasing of one of its larger vessels.

- MMA’s larger boats (MPSVs) were less utilised over the period which also dragged down revenue.

FY-22 and beyond

- The company continues to pursue work outside of oil and gas, with offshore wind presenting a large opportunity. A return of offshore oil and gas activity should see the vessel market tighten and day rates begin to lift, much of which will flow through to the company’s bottom line.

- MMA is in the best position it has been to benefit from a recovery, its balance sheet is in much better shape, with the realisation of vessels for sale likely to further strengthen its position.

Company description: Platinum is an Australian based investment manager with a focus on international shares. Flagship funds include Platinum International Fund and the Platinum Asia Fund.

1H-FY22 Result

- With fund performance and flows largely preannounced (i.e. the level of assets under management – which Platinum earns fees on), the market was largely focused on Platinum’s costs for the first half.

- These disappointed, with employee expenses continuing to rise (share-based payments rose over the half).

FY-22 and beyond

- Platinum remains fundamentally cheap – and (based on the first half) will pay a ~9% dividend for the year.

- We expect to see a turnaround in its share price as investment performance improves – noting that Platinum’s funds have a heavy bias towards value stocks which we believe should outperform in an inflationary environment.

- With an improvement in performance, we should see an improvement in fund flows and a ‘re-rating’ of the company.

Company description: Inghams is one of the two largest poultry producers in Australia.

1H-FY22 Result

- As highlighted in the media, Ingham’s result was significantly impacted by COViD for the half. Absenteeism and labour constraints resulted in more chickens being sold through the wholesale and export channels (as opposed to retail and higher value add channels) at lower margins, which dragged down the company’s result.

- Furthermore, the company has been impacted with higher feed costs which have not yet been passed through to higher prices.

FY-22 and beyond

- With the easing of COViD restrictions and labour constraints, we expect to see a big reset in the company’s profitability.

- Furthermore, given the inflation we are beginning to see in supermarkets (particularly in meat), we expect to see Inghams materially benefit from any price rises it can implement.

Company description: It is a global private hospital operator with locations in Australia, the UK and France

1H-FY22 Result

- Ramsay’s result for the first half was still significantly impacted by COViD and restrictions on elective surgeries. While in some geographies (such as the UK and France) this has been offset somewhat by revenue guarantees, there was still a material impact.

- The company is experiencing cancellations of procedures as well as some labour pressures, with the exit of workers from the workforce and COViD related disruptions. However, it is looking to offset this through recruitment and negotiating higher revenue with payers (such as Private Health insurers and governments).

FY-22 and beyond

- The second half of the financial year should see a rebound in activity for Ramsay, with restrictions being eased from January.

- We took particular notice of a comment by CEO Craig McNally, which highlighted that the current pressures on the public hospital system (COViD) is likely to drive volumes to the private system, which should materially benefit Ramsay.

- Thus, we see it is a case of short-term challenges, long term opportunity.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.