The Markets

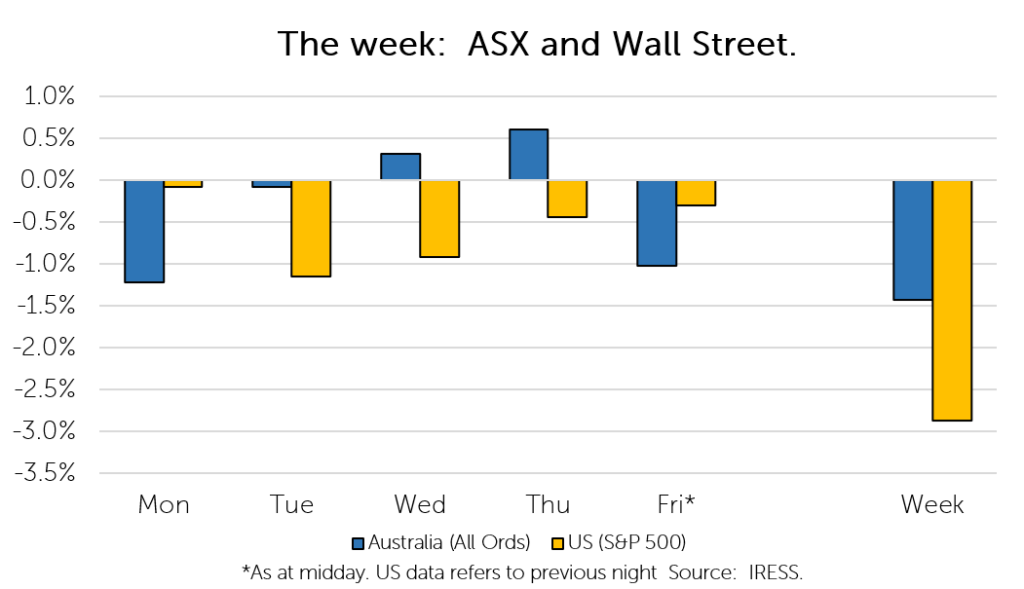

This week: ASX v Wall Street

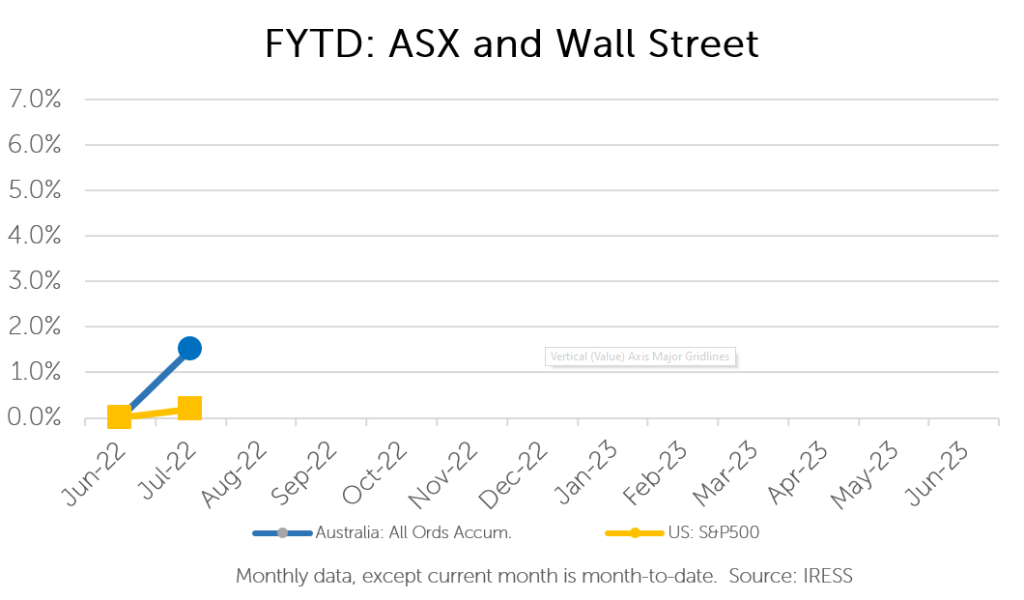

FYTD: ASX v Wall Street

A resurgence of COVID, astronomical prices at the bowser, conflict in Europe, $7 lettuce!

If you are feeling a little uneasy about the Australian economy, you are not alone.

Recent surveys indicate Australians are increasingly worried about the outlook for the domestic economy.

We take a walk down a chart-filled page to see what exactly consumers are fretting over and how this is influencing behaviour.

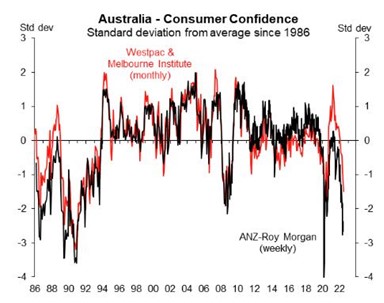

Increasingly worried

The latest Westpac-Melbourne Institute Survey of Consumer Sentiment revealed that Australians are increasingly pessimistic about the economy.

In fact, consumer confidence is at its lowest levels (barring COVID) since the “recession we had to have”:

Source: Macquarie Research

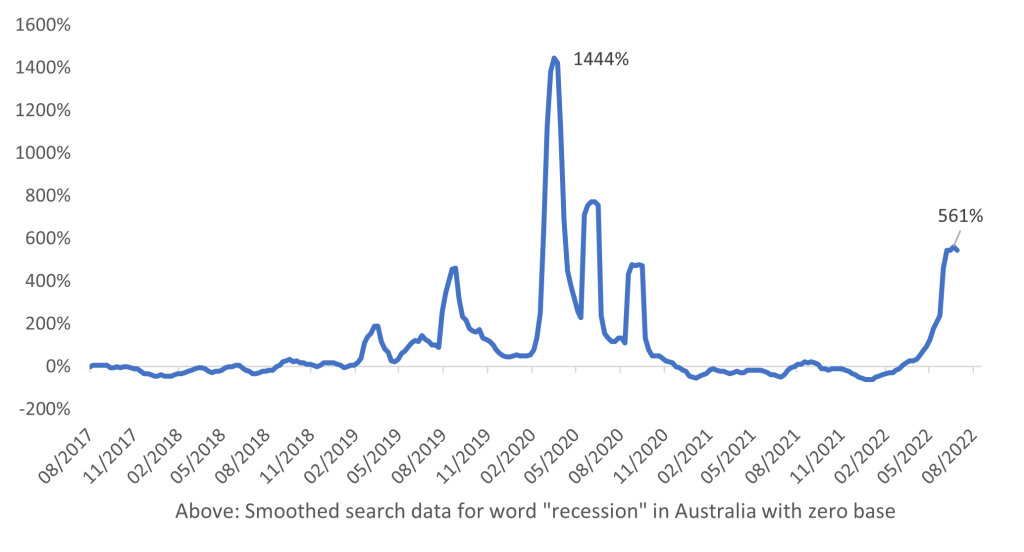

While surveys are one measure, alternative data sources are increasingly providing real-time data to help us put our finger on the pulse of the economy.

For example, Google Trends indicate that Australians are rushing to search for the word “recession”, although in far smaller numbers than at the peak of the pandemic.

Source: Google Trends, First Samuel

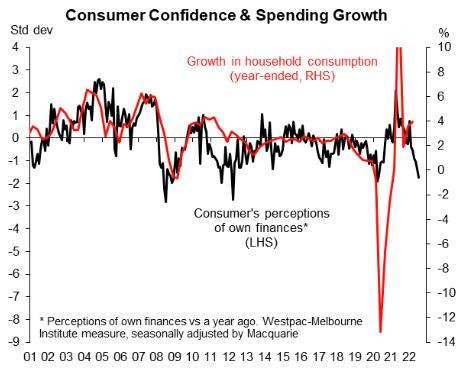

Furthermore, consumers’ perceptions of their own finances are increasingly deteriorating. This is curious, given the charts that follow, which indicate households are doing well, at least at present.

Source: Macquarie Research

But seemingly “ok” today

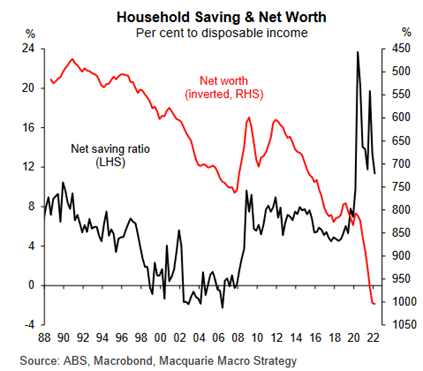

This doom and gloom comes despite households having saved a large amount of money during the pandemic (although we note that when separated into income deciles this is heavily skewed towards wealthier households), and in aggregate never having been wealthier.

Source: Macquarie Research

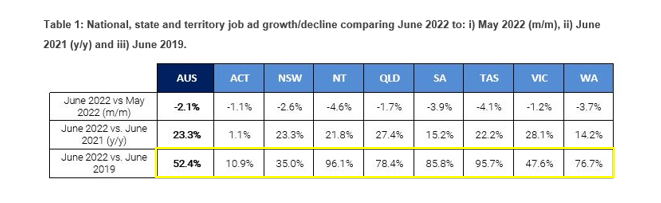

It also occurs despite a still red-hot jobs market, with job ads more than 50% higher compared to before the pandemic.

Source: Seek

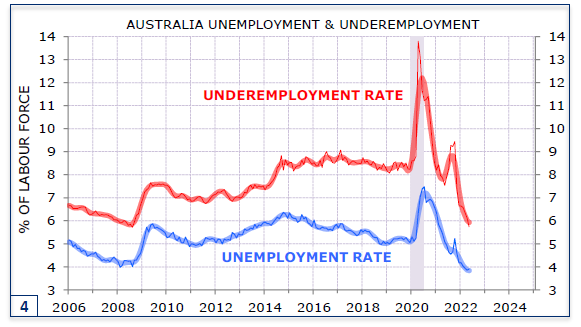

…despite decades low levels of unemployment, with the most recent print released yesterday indicating the tightest job market since 1974.

Source: Minack Advisers

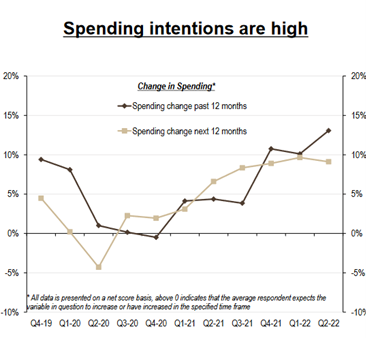

And despite survey measures indicating they still plan on spending in the near term (although we question the degree to which this is a “pulling forward” of demand given inflationary pressures).

Source: UBS

Trying to solve for the cognitive dissonance

Based on the charts above, current conditions appear to be relatively good (although many of these are lagging indicators, that is, measures of what has happened in the past).

However, a patient’s pain should not be ignored, even if their vital signs appear normal.

The prospect of paying more for less, in an environment where wage growth is being actively discouraged, no doubt has households’ neurons firing in anticipation of deteriorating future conditions.

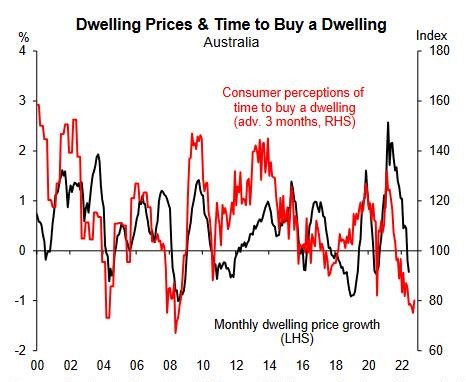

We see this manifesting in several forms. One is in the willingness (or lack thereof) to spend on big purchases.

Households are increasingly skittish when asked if it is the “right time” to buy a dwelling.

Source: Macquarie Research

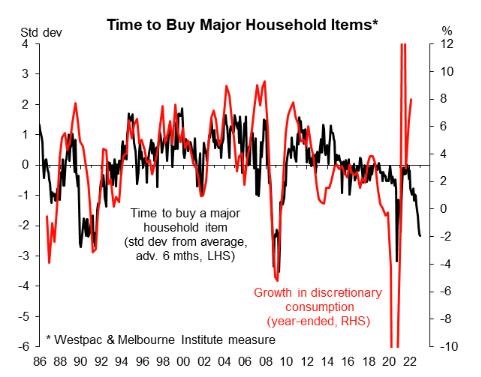

Furthermore, perhaps also reflecting uncertainty around the longer-term outlook, households are increasingly nervous about buying big ticket items:

Source: Macquarie Research

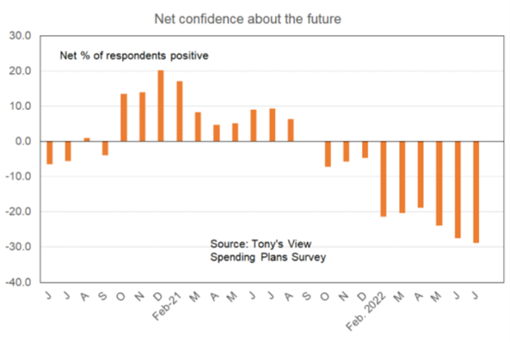

And they are not alone. This nervous sentiment is shared across the ditch, where a cooling housing market is facing rapidly rising interest rates.

The chart below plots the net of responses to the question: “are you confident about the future”. This has taken a rapid turn as the RBNZ has begun cranking interest rates higher.

Source: MacroBusiness

In general, how economies fare in the next 12-18 months is uncertain and a cause of considerable consternation.

There are many factors at play, including rising interest rates, inflation (and the impact they have on the purchasing power and disposable income of households), a slowing China, conflict abroad and a re-emergence of COVID.

Whether these nerves are justified, and the degree to which these nerves will be self-reinforcing (reflexive) remains to be seen.

Are we as nervous as households are? We remain cautious and forward-looking, particularly with respect to the domestic economy.

In general, we are positioned for the possibility of a weaker Australian economy in the near term.

Company News

Australian Equities sub-portfolio

MMA Offshore (positive impact) announced the award of a new contract for one of its vessels.

The MMA Leeuwin, a platform supply vessel (PSV), will be contracted for a period of 200 days to provide vessel services for OMV New Zealand, with an additional option of 150 days.

The contract value is expected to be between A$10-11 million which includes the period to mobilise the vessel to and from Western Australia.

Why did our ears perk up on the news? Well, the contract value implies a vessel day rate of approximately $45,000 per day (conservatively), which by our estimates is significantly higher than day rates we have seen in the past.

While a portion of this likely reflects higher labour costs, the magnitude of the increase gives us some optimism that the market for offshore vessels is continuing to tighten, given a renewed impetus for oil and gas capital expenditure.

Costa Group (negative impact) responded to what was an odd day in the trading of its shares.

Recent weather events have created some quality issues with its citrus crops, namely Navel oranges.

This is expected to impact harvest volumes, although we are early in the citrus season so it is difficult to tell what the full impact will be.

The company expects to provide a more detailed update at its upcoming earnings result.

Weather events are always a risk present when investing in agricultural companies. However, we note that a large proportion of Costa’s growing operations are grown in sheltered or controlled environments (mushrooms, tomatoes, blueberries) and this risk is often more than discounted in its share price.

Alternatives sub-portfolio

Seer Medical is a new addition to Alternatives sub-portfolios

Seer, founded in 2016 takes the diagnosis and monitoring of epilepsy out of the hospital and into the home. The company was recently named as the inaugural winner of Governor of Victoria Start-up award.

Why is this important? Well, the diagnosis and monitoring of epilepsy can be difficult. Patients can often have a seizure without being conscious of it or any outward appearance of pathology. Diagnosis in hospitals is a resource-intensive processes. Seizures can be sporadic in nature and require a monitoring period of weeks.

Seer’s solution is to take diagnosis and monitoring into the home, allowing for a much wider window diagnose and characterise brain activity. The Seer Home system, which rests over the shoulders like a collar, allows for simultaneous video, EEG and ECG monitoring.

Source: Seer

This provides for a more affordable, more accurate way of collecting data for decision-making. Seer pairs this data with machine learning to create cloud-based reports for neurologists to analyse (helping cut down what can be an up to 40 hr period for review).

Improved patient outcomes are paired with a strong commercial driver for adoption. In hospital, monitoring comes at a significantly higher cost with an associated burden on our most critical infrastructure: hospitals.

This will hopefully mean not only better diagnosis, but also better monitoring and treatment of epilepsy, allowing for the titration of medication, better identification of triggers and over time (with enough data) better overall diagnosis.

The investment may strike some clients as similar to their holding in EpiMinder. Indeed, the companies are collaborating to help deepen the pool of data available.

However, Seer is more focused on diagnosis and monitoring during acute episodes, while EpiMinder is an implanted device designed to assist in the longer-term (beyond weeks) monitoring of epilepsy, which is being paired with artificial intelligence to enable seizure forecasting.

The company has already had significant success in Australia and is looking to expand into the US and Europe.

Clients participated in a pre-Series B investment round, with the position making up a modest part of Alternative sub-portfolios (approximately 2.5%).

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.